As a non-resident, mortgage financing is generally available at 65% so you'll need 35% as a down payment. Some lenders may require 40% or more depending on your circumstances and the property. Qualifying for mortgage financing in Vancouver is similar to other countries and can usually be accomplished via fax and e-mail. The mortgage approval may take a few days and the mortgage broker will advise you what information they need. The borrower will require the services of a Canadian lawyer or notary public to prepare the mortgage documents and registration at the Land Titles office. Documents can be couriered outside Canada for signing - this can be arranged with the lawyer and lender well in advance of the completion date.

INFORMATION FOR NON-RESIDENTS WHO WANT TO BUY REAL ESTATE IN CANADA

Non-residents are permitted to stay in Canada 180 days each year, and are generally not restricted from buying properties in British Columbia.

Here is a collection of important information that non-residents looking to buy properties in Canada may find useful.

Mortgage Financing

Purchase Costs

Costs to purchase real estate in Vancouver, BC are the more or less the same for residents and non-residents.

Realtor Commissions

In the Vancouver real estate market realtors commissions are paid by the Seller so as a Buyer you generally do not pay any commissions. The Seller typically pays one commission which is then split between the Buyer's and Seller's realtors.

Rules for Non-Resident Property Owners (by Gabrielle Loren, CGA)

Rental Property

NR6

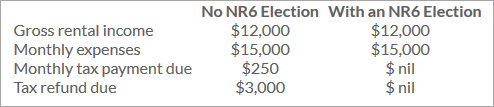

If you purchase property that you rent out, you have to file an NR6 form before the first month's rent is received. This form allows you or your agent to remit taxes on your net estimated rental income vs. remittin 25% of your gross rental income. The NR6 form is a joint election between yourself as the owner and your agent stating that you will file a Section 216 Canadian tax return by June 30th of the following year and pay taxes due by April 30th of the same year. The following demonstrates further:

As you can see, this is a cash flow issue more than anything so it is very important to file this form. You will need details of your anticipated expenses in order to complete it - see detailed list below - plus the name, address, and phone number of your Canadian agent.

If you have no agent, you must remit 25% of your rental income to the government by the 15th of the month following the month in which the rent was received. In other words, January you collect $1,000 rent, then by February 15, you have to pay $250 to CRA.

Section 216 Return

This is a special rental income return that is due to be filed by June 30th of the following year. I.E. your 2008 return is due June 30, 2009. If taxes are payable, they are due April 30th and interest accumulates on the amount due after this date.

The return calculates taxes due on your rental profit. Allowable expenses include:

- Advertising

- Mortgage interest (not payments)

- Property taxes

- Repairs and maintenance

- Utilities

- Office supplies (receipt books etc)

- Travel (for you to do or supervise repairs at the unit but these are limited to airfare and rental car - no hotel)

Gabrielle Loren, CGA

Loren, Nancke & Company, CGA's

Contact: 604-904-3807

Web: lorennancke.com

Informative Links and Referrals

- Buying and Selling Canadian Property: an overview for non-residents by BCREA

- Citizenship and Immigration Canada

- Arthur Azana of D+H Group LLP Cross Border Chartered Accountant

- Mohammad Ahmad of WestMark Tax Chartered Accountant

Please see the article below by Immigration Lawyer David Aujla for some helpful information

FIVE IMPORTANT QUESTIONS (by David Aujla, Immigration Lawyer)

Over my years of practice, I have noted that there are five questions that foreign nationals usually ask prior to applying for immigration. Here are the questions and the answers:

1. Will buying a house or a business help my immigration to Canada?

Buying a house does not increase chances of entry, but nor does it hurt. The purchase of a home certainly shows a connection to Canada and the home is ultimately treated as a part of the overall net worth of the individual, but simply owning a house and living here as a visitor will not affect the selection process.

Buying a business, however, could result in a faster entry into Canada based on a temporary work permit. CAUTION! Buying a business must be part of a comprehensive immigration strategy. The purchase must be strategized with other qualifying factors, such as overall asset base, the projected performance of the business and previous business experience.

These important aspects are examined and must be approved by the provincial government and/or the federal immigration department before any business is purchased. It is best to seek professional taxation and legal advice prior to purchasing a home or business.

2. As a foreigner can I get a mortgage?

The answer is yes. The requirements for obtaining a mortgage to finance a purchase, whether a home or a business, will depend on the institution with which the foreign national will do business.

Generally speaking, there is usually not a problem in securing mortgages with more-established financial institutions. These institutions will usually require a letter of introduction from the previous banking facility with which the foreigner has done business in his or her own home country. Previous income in the home country will also be verified. Also, institutions may require a greater percentage of the purchase price as a down payment.

3. How long can I stay in Canada? (Can’t I just go out for a day and come back?)

Generally, a person is allowed a six month entry as a visitor. If a second home is purchased, one can bring in a reasonable amount of furniture as a “seasonal resident” without paying any duty.

There is no corresponding regulation in the immigration act (IRPA) that states the person has to leave for six months before returning, so multiple entries can be allowed. CAUTION! You cannot “flagpole” continuously. Flagpoling means leaving Canada for a few days and then returning to Canada. Although such re-entry may be allowed on one or two occasions, the person does run a risk of being refused entry into Canada because he or she is living in Canada as a resident under the guise of being a visitor.

The foreign national must maintain substantial roots with his or her home country. See the following website: https://www.bcimmigration.com/flagpoling/

4. If I rent out my home, what are the tax implications?

Occasionally, foreign nationals will purchase a home, reside in it for a few months of the year and rent it out for the balance.

NOTE: Special tax rules do apply to such situations and Canadian tax returns must be filed by the foreigner. In fact, if the taxation payments are not set up properly, the foreign landlord will be required to pay 25% of the net rental income per month to the tax department as a holdback until the tax returns are filed. However, such a drastic reduction of rent can be avoided if a Canadian resident is appointed on behalf of the foreign national to make the filings at the end of the year.

CAUTION! When selling a residence, a foreign national must file a clearance certificate well in advance of the sale or there can be up to a twenty five percent holdback of the full selling price until the clearance certificate is obtained from the tax department.

5. Can I retire in Canada?

There is no retirement category under the immigration regulations. Such an avenue did once exist, but the retirement avenue of immigration was phased out in the late 1980s.

If an individual is buying a home with the view of ultimately retiring here, it is important to seek legal immigration advice immediately. Qualifying for immigration is time sensitive in that points are awarded based on the number of years of experience in both business and in work as well as the age factor.

It is important that as soon as individuals are considering purchasing a home here in Canada that they seek immediate immigration legal advice to ensure that a proper strategy exists for the potential permanent entry in the future. There are also health and age-related questions which may impact the admissibility.

S. DAVID AUJLA, B.Sc., LL.B., M.A., L.Ph.

VICTORIA OFFICE

800 - 1070 Douglas Street, Victoria, British Columbia, Canada, V8W 2C4

Phone Number: 250-383-3542 | Email address: info@bcimmigration.com

VANCOUVER OFFICE

440 Cambie Street, Suite 101, Vancouver, British Columbia, Canada, V6B 2N5

Phone Number: 604-630-2244 | Email address: info@bcimmigration.com

Website: https://www.bcimmigration.com/